Online Banking

Member Sign In

Are you a new member? Register here!

Are you a new member? Register here!

Understanding Net Worth

Net worth is a key financial metric that measures the value of an individual’s or household’s assets minus their liabilities. In simple terms, it reflects what you own versus what you owe. It’s often used as a snapshot of one’s overall financial health and long-term wealth accumulation.

Read MoreHow to Talk to Your College Grad About Retirement

Your new graduate is likely focused on landing a job, repaying student loans, and figuring out how to manage daily expenses. As a parent, mentor, or financial guide, you play a pivotal role in helping them understand why retirement saving should start now, not later.

Read MoreUnderstanding HELOCs: A Flexible Financial Tool

A Home Equity Line of Credit (HELOC) is a versatile financing option that allows you to tap into your home's equity for various needs, such as home improvements, debt consolidation, or covering unexpected expenses.

Read MoreShould You Buy or Rent a Home in Houston, Texas?

Houston's housing market in 2025 presents a dynamic landscape for potential buyers and renters. Our experts at Smart Financial are here to help you navigate the world of home mortgages and set you up for success.

Read MoreThe Value of Budgeting and the Power of Paying Yourself First

Whether you're striving to pay off debt, save for a home, or prepare for retirement, one fundamental principle remains consistently effective: budgeting. And within the broader practice of budgeting, one strategy stands out for its simplicity and effectiveness—paying yourself first.

Read MoreThe Importance of Contributing to a 401(k)

When it comes to securing your financial future, few tools are as effective and accessible as a workplace 401(k) plan—a tax-advantaged way to build a nest egg.

Read MoreHoliday Season Scams

The Holiday season is upon us! Unfortunately, it brings an uptick in scams and fraudulent activities that prey on the goodwill of unsuspecting individuals. In this article, we'll explore the most common scams targeting consumers during the holidays and provide you with actionable tips to safeguard yourself.

Read MoreInternational Credit Union Day 2024

We dive into the significance of International Credit Union Day and how Smart Financial goes beyond the traditional one-day celebration.

Read MoreCurrent State of the Mortgage Industry

Listen in to the latest episode of The Full Circle podcast, where we talk shop and Mortgage with our Vice President of Relationship Development, Angela Aguirre.

Read MoreOnline Scams

Being aware of scams is essential to keep safe from unscrupulous fraudsters and protect yourself online. Here are some of the most common scams that occur and what to watch out for.

Read MoreElderly Scams

Here are a number of common scams that target the elderly. We hope this is helpful for our members to avoid falling into these traps, whether you are elderly yourself or have loved ones that may be susceptible.

Read MoreInternational Credit Union Day

Discussing International Credit Union Day with Vice President of Community Relations, Shana Scott.

Read MoreThe Full Circle: Credit Union Membership

Shirley Brothers, a member since 1971 talks about the impact Smart Financial has had on her financial health.

Read MoreThe Car Buying Process

Buying a car can be a stressful process - but it doesn't have to be with Smart Financial.

Read MoreThe State of Credit Unions

Discussing the current state of financial institutions with LeAnn Kaczynski, Chief Executive Officer of Smart Financial.

Read MoreDebunking Myths About Credit Unions

Debunking Myths About Credit Unions with Preston Price, Chief Experience Officer of Smart Financial.

Read MoreThe Full Circle: Community Partnership

Dr. Bostic, Superintendent of Stafford MSD shares his experience about partnering up with Smart Financial in the community.

Read MoreWhy Choose a Credit Union?

There are important distinctions between banks and credit unions, even though they offer similar products.

Read MoreCredit Score Refresher

Is improving your Credit Score on your list of New Year’s resolutions? Try to keep these tips in mind!

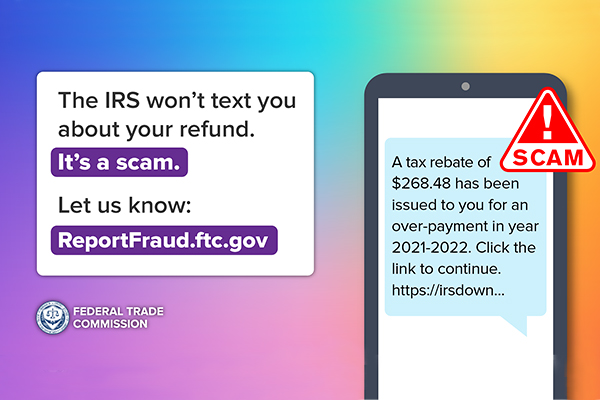

Read MoreTax Season Fraud

As tax season gets under way, here's an important reminder to remain vigilant against IRS impersonators.

Read MoreThe Full Circle: Investing In CDs

Longtime member, Chris Caldwell, talks about how investing in CDs helped him get his financial life back on track.

Read MoreDo You Need Life Insurance?

One of the most important questions to ask yourself is what would happen to my family and spouse if I suddenly passed away?

Read MoreBudgeting for Inflation

55% of Americans say inflation has caused financial hardships in their household. That's the reality of inflation. What can you do about it?

Read MoreHomebuying Tips

Today's environment of high interest rates, home prices and inflation make homeownership seem unattainable. Here are some tips to help prepare you.

Read MoreHoliday Season Safety

While it's easy to get caught up in the hustle and bustle of holiday shopping, parties and events, it's more important than ever to stay vigilant through it all.

Read MoreBe Alert: Holiday Cyber Scams

This is your annual reminder to be on the lookout for all kinds of cyber creeps waiting to take advantage through our holiday shopping.

Read MoreRainy Day vs. Emergency Fund

Unexpected expenses happen but being prepared with the proper savings can help make your finances a little less stressful!

Read More