Online Banking

Member Sign In

Are you a new member? Register here!

Are you a new member? Register here!

SMART CHECKING

Personal

Checking

Accounts

Personal Checking that evolves with you.

Compare Checking Accounts

Spending starts in our teens, becomes reality in young adulthood, gets complex in parenthood, and even more so in retirement. Wherever you are in life, we have a Smart Checking account for you with tools that help you save time and spend smarter!

Smart Scholar

CHECKING

Teaches your teen to bank without fees while you monitor spending. Visit a branch to open.

- Ages 14 to 17

- $25 to open

- No minimum balance

- $10 monthly service fee

ages 18 and over - view all

- Smart Scholar Checking Account

- Ages 14 to 17

- $25 to open

- No minimum balance

- $10 monthly service fee ages 18 and over

- Fee waived ages 17 and under

- No Check Writing

No Bill Pay - No discretionary overdraft protection

- Overdraft Protection from Savings

- Free paper statements by request

- Parent/Guardian access to monitor & pay allowance

- Smart Start Checking Account

- Ages 18 to 25

- $25 to open

- No minimum balance

- $10 monthly service fee ages 26 and over

- Fee waived ages 25 and under

- Check Writing & Bill Pay

- No discretionary overdraft protection

- Overdraft Protection from Savings and Line of Credit4

- Free paper statements by request

- Higher ATM & Purchase limits than Smart Scholar

- Smart Choice Checking Account

- Ages 18+

- $50 to open

- No minimum balance

- $10 monthly service fee

- Fee waived if ANY apply:

- 20+ debit card POS/mo.

- direct deposit > $500/mo.

- members ages 65+

- Check Writing & Bill Pay

- Optional Discretionary Overdraft Protection4

- Overdraft Protection from Savings and Line of Credit4

- Free Monthly E-Statements (Paper Statements - $2)1

- One box free checks per year ages 65+

- Higher ATM & Purchase limits than Smart Start

- Smart Premier Checking Account

- Ages 18+

- $100 to open

- No minimum balance2

- $15 monthly service fee

- Fee waived if ANY apply:

- $15K combined average balance (deposits/loans) for the primary account holder

- direct deposit > $3,000/mo.

- Check Writing & Bill Pay

- Optional Discretionary Overdraft Protection4

- Overdraft Protection from Savings and Line of Credit4

- Free ATMs up to $10/month5 & Free Money Orders/Cashier's Checks

- Higher ATM & Purchase limits than Smart Choice

Frequently Asked Questions

How much money do I need to open a checking account?

Smart Financial offers a variety of checking options to fit the diverse needs of our members. Our Smart Start checking product is designed for members who are getting started on their financial journey— this account can be opened for as little as $25. More established members may choose from our Smart Choice or Smart Premier checking with minimum openings starting at $50. Learn more at www.smartcu.org/personal/checking-accounts

What fees are charged for checking accounts at Smart Financial?

Fees for checking vary depending on the checking account your choose, with ways to avoid fees altogether with certain activity with your checking account. Our fee schedule is located at https://www.smartcu.org/personal/rates-fees

Can I use online and mobile banking to manage my checking account?

Yes of course! With our mobile app and online banking you have access to your checking account statements, ability to set up notifications and alerts to help you manage your account, bill pay, mobile deposits, as well as other convenient features to get the most out of your checking account with Smart Financial.

How can I order more checks?

Checks can be ordered through our website at https://www.smartcu.org/personal/checking-accounts. Just scroll to the bottom for a link to order additional checks! You can also order checks through online banking: Financial Tools>Checking Services>Reorder Checks.

Do I need to become a member of Smart Financial in order to open a checking account?

Yes. All of our checking products are available to Smart Financial members only, but joining Smart Financial is as easy as one, two, three! Plus, membership comes with a host of great benefits and resources to help you achieve success along your financial journey! Visit https://www.smartcu.org/about-smart/membership to learn more about joining the Smart Financial team!

How is the average daily balance calculated?

To calculate the average daily balance (ADB) you would need to add the daily balance for each day in the timeframe and divide the total amount by the number of days during the period. An example would be: June has 30 days, so you would take the balance at the end of each day, add those together and divide by 30 to get the ADB.

How do I stop payment on a check and are there any fees involved?

• Complete a Stop Payment form in a branch

• Online Banking

• Through Call Center electronically

• Yes, there is a fee of $30.00

What is your routing number?

313083578

How long does it take to receive my debit card after I open my checking account?

Digital card is received via text within minutes of being ordered. Physical card is received within 5-7 business days. We let members know 7-10 business day turnaround.

Does Smart Financial offer overdraft protection for checking accounts?

Yes, from a linked account owned by the member. Discretionary overdraft protection is available 60 days after account opening, if the member qualifies.

How can I access my checking account balance?

• Online Banking

• Text Banking

• Telephone Banking

• Call Center

• In Branch

• ATM

• Account Statement

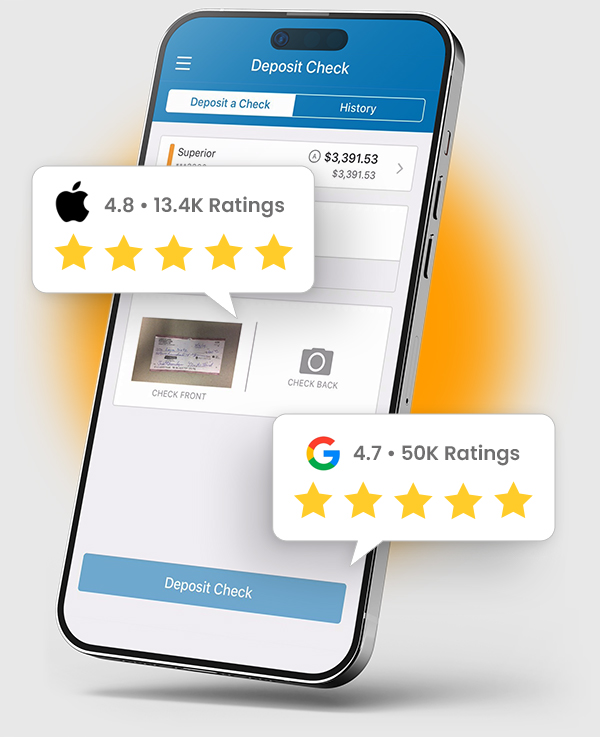

Make mobile deposits from anywhere

With Apple or Android device, you can deposit checks remotely—wherever you are, whenever you want.

deposit checks in 5 simple steps

super easy - app walks you through it

deposit checks to checking and savings

Applicable to all Smart Financial Checking products: If you're a new member and using a checking account to establish Smart Financial membership, you will pay a one-time $5 entrance fee in addition to the minimum opening deposit required by the account.

1. Smart Choice Checking is subject to a $10 monthly service fee. Requirements to waive the fee include one of the following: 1) have a monthly recurring direct deposit of $500 or more, 2) complete at least 20 Point Of Sale (POS) debit card transactions per month (ATM transactions do not apply), OR 3) primary account holder is 65 years of age or older. If direct deposit stops AND POS transactions stop meeting these requirements within a 30 day statement period, the $10 monthly will apply and will continue to be charged to your account until ONE of the THREE qualifications has been re-established. Terms and conditions may change at any time without prior notice. The monthly service charge will be waived for the first 3-months of account opening to allow for the initiation of the direct deposit. Smart Choice Checking statements will be delivered electronically. If paper statements are desired, the member may opt in but will incur a $2 statement fee.

2. Smart Premier Checking is subject to a $15 monthly service fee. Requirements to waive the fee include one of the following: 1) the primary account owner must maintain an average of $15,000 combined loan and account balances per month, OR 2) have a monthly recurring direct deposit of $3,000 or more. If direct deposit stops AND the average monthly combined balances drop below threshold, the $15 monthly fee will apply and will continue to be charged to the account until ONE of the TWO qualifications has been re-established. Terms and conditions may change at any time without prior notice. The monthly service charge will be waived for the first 3-months of account opening.

3. Smart Premier dividend rate is tiered and based on average balance during a 30-day period. Rates are subject to change and posted at www.smartcu.org.

4. Discretionary Overdraft Protection (DOP) and Line of Credit (LOC) privileges must be qualified and approved.

5. Qualifying Premier accounts will be reimbursed up to $10 per month, or $120 per calendar year, for accrued ATM surcharges (3rd party fees). In addition, no Smart Financial ATM fees will accrue on Smart Premier accounts.

6. Mobile Deposit is available through our Mobile App. There are restrictions and qualifications in order to be eligible for this service. Your account must be open at least 60 days and maintain a positive balance. All checks deposited through the mobile app are not made available immediately. Other restrictions apply. Visit smartcu.org/mobile to learn more.